Guided Wealth Management - Questions

Guided Wealth Management - Questions

Blog Article

Our Guided Wealth Management Ideas

Table of ContentsThe 6-Minute Rule for Guided Wealth ManagementGuided Wealth Management Fundamentals ExplainedFascination About Guided Wealth ManagementThe Of Guided Wealth ManagementGuided Wealth Management Can Be Fun For Anyone

For even more pointers, see track your investments. For investments, make settlements payable to the product provider (not your consultant) (superannuation advice brisbane). Frequently examine transactions if you have an investment account or utilize an financial investment system. Offering an economic adviser full access to your account enhances danger. If you see anything that does not look right, there are steps you can take.If you're paying a recurring guidance cost, your consultant should evaluate your financial situation and consult with you a minimum of yearly. At this meeting, ensure you go over: any changes to your objectives, circumstance or financial resources (consisting of adjustments to your earnings, expenses or possessions) whether the level of threat you're comfy with has altered whether your existing individual insurance cover is ideal just how you're tracking against your goals whether any type of changes to regulations or economic items can impact you whether you have actually obtained everything they assured in your contract with them whether you need any modifications to your plan Every year an adviser need to seek your written grant bill you continuous suggestions charges.

This may occur throughout the meeting or online. When you get in or restore the ongoing charge plan with your consultant, they should describe exactly how to finish your partnership with them. If you're transferring to a new advisor, you'll need to organize to move your monetary documents to them. If you require aid, ask your consultant to describe the process.

What Does Guided Wealth Management Mean?

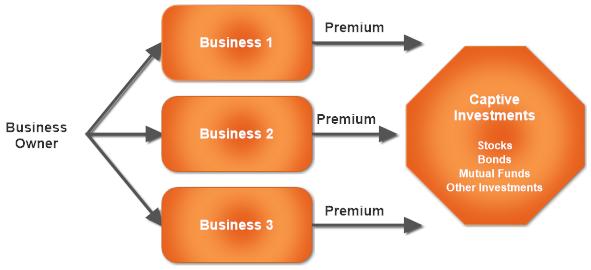

As an entrepreneur or little company proprietor, you have a great deal taking place. There are many duties and expenses in running a company and you certainly do not need one more unneeded bill to pay. You need to thoroughly consider the roi of any solutions you reach ensure they are rewarding to you and your organization.

If you are just one of them, you might be taking a substantial threat for the future of your company and on your own. You may intend to continue reading for a checklist of reasons that hiring a monetary expert is beneficial to you and your company. Running a company contains difficulties.

Money mismanagement, cash money flow problems, overdue settlements, tax obligation concerns and various other economic troubles can be critical adequate to close a service down. That's why it's so essential to control the economic aspects of your company. Employing a reputable financial advisor can stop your company from going under. There are lots of manner ins which a certified financial expert can be your partner in helping your organization flourish.

They can deal with you in assessing your economic scenario often to avoid severe blunders and to quickly correct any kind of negative money choices. A lot of small company owners put on several hats. It's easy to understand that you intend to conserve cash by doing some jobs yourself, yet handling financial resources takes expertise and training.

How Guided Wealth Management can Save You Time, Stress, and Money.

Planning A company strategy is critical to the success of your service. You need it to understand where you're going, how you're arriving, and what to do if there are bumps in the roadway. An excellent economic advisor can create a thorough plan to help you run your service much more effectively and plan for abnormalities that develop.

A respectable and knowledgeable financial consultant can assist you on the financial investments that are right for your company. Cash Cost savings Although you'll be paying a monetary consultant, the long-lasting cost savings will validate the price.

Reduced Tension As an organization proprietor, you have lots of things to fret around. A great economic expert can bring you peace of mind knowing that your funds are getting the focus they need and your money is being invested sensibly.

All about Guided Wealth Management

Stability and Development A qualified monetary expert can offer you clearness and aid you concentrate on taking your company in the ideal instructions. They have the tools and sources to use strategies that will ensure your service expands and flourishes. They can assist you analyze your objectives and determine the most effective course to reach them.

The Buzz on Guided Wealth Management

At Nolan Accountancy Center, we give experience in all aspects of economic planning for small companies. As a tiny service ourselves, we understand the difficulties you face on a daily basis. Offer us a telephone call today to go over just how we can help your organization flourish and do well.

Independent ownership of the practice Independent control of the AFSL; and Independent reimbursement, from the customer only, via a set buck cost. (https://www.figma.com/design/uJ6cz9mANpOboXXyUreFwV/Untitled?node-id=0-1&t=r2CeAemZ4UWS22R1-1)

There are various benefits of a monetary planner, no matter of your circumstance. However despite this it's not unusual for people to 2nd guess their suitability as a result of their placement or present investments. The objective of this blog straight from the source is to prove why everybody can take advantage of a monetary plan. Some usual worries you may have felt on your own consist of: Whilst it is very easy to see why individuals might think this way, it is absolutely wrong to consider them correct.

Report this page